Canceling an Insurance Claim Under Investigation in Oklahoma or Texas

We will discuss whether you could cancel an insurance claim under investigation in Oklahoma or Texas and why understanding this process is crucial.

Insurance claims can be a complex and time-consuming process, especially when they are under investigation. If you find yourself in this situation, you may wonder if it’s possible to cancel the claim altogether. Well, the answer is not as straightforward as you might think.

So grab a cup of coffee and let’s dive right in!

Importance of Understanding the Steps to Cancel an Insurance Claim Under Investigation

Understanding the steps to cancel an insurance claim under investigation is vital for policyholders. It allows them to navigate through challenging situations and make informed decisions about their claims. Canceling a claim may be necessary in certain circumstances, such as when clear evidence of error or new information emerges that changes the situation.

When faced with an ongoing insurance claim investigation, it’s essential to grasp why insurance claims are investigated in the first place. Insurance companies conduct investigations primarily to prevent fraud and ensure that only valid claims are paid out. This helps maintain the integrity of the insurance system and keeps premiums affordable for everyone.

Insurance adjusters play a crucial role in investigating claims. They gather and prepare evidence related to the incident, interview involved parties (such as witnesses or other drivers), and assess liability based on established guidelines. Understanding their responsibilities can help policyholders better navigate communication channels during the cancellation process.

Cooperating fully with the insurance claim investigation is paramount when seeking to cancel a claim under scrutiny. Staying transparent with your insurance company, providing relevant information promptly, and cooperating during interviews will facilitate smoother communication throughout this complex procedure.

It’s important for policyholders to be aware of any timeliness or deadline constraints associated with canceling an insurance claim under investigation. Failing to meet these deadlines could have significant consequences on future coverage options or result in denied cancellations altogether.

Additionally, steps to cancel an insurance claim under investigation can have several long-term ramifications. It may impact future coverage eligibility, potentially leading insurers to view you as a higher risk and resulting in increased premiums down the line. Furthermore, canceled claims will also affect your claims history records.

Legal considerations should not be overlooked either when contemplating canceling a claim under investigation. Compliance with all applicable laws and regulations is crucial during this process, ensuring that you do not face any legal repercussions from terminating your claim prematurely.

Understanding how to cancel an insurance claim under investigation is essential knowledge for policyholders facing challenging situations like errors or new evidence emerging. By comprehending the insurance claim investigation process and cooperating with insurers.

Overview of Insurance Claim Investigation

Insurance claim investigation is a crucial part of the claims process that helps insurance companies determine the validity and accuracy of a claim. It involves gathering information, analyzing evidence, and determining liability to make fair and informed decisions.

One of the main reasons why insurance claims are investigated is to prevent fraud. Insurance fraud is a serious problem that costs the industry billions of dollars annually. By thoroughly investigating claims, insurance companies can identify any fraudulent activity or false information policyholders provide.

During an investigation, insurance adjusters play a key role in collecting and evaluating evidence related to the claim. They may visit the accident site, gather witness statements, review medical records, or consult with experts to assess damages. Their goal is to gather all relevant information needed for an accurate assessment.

Interviewing involved parties also plays a significant role in the investigation process. Adjusters may speak with policyholders, witnesses, or other individuals involved in the incident to gather their perspectives and obtain additional details about what happened.

Am I in trouble if my insurance claim is being investigated

In some cases, clear evidence of error or new evidence that changes the situation may arise during an investigation. This could be eye-witness accounts contradicting initial reports or previously undisclosed information coming to light. In such circumstances, canceling an insurance claim under investigation may be considered.

Canceling an insurance claim under investigation requires contacting your insurance company and notifying them about your decision. It’s important to provide all relevant information supporting your request for cancellation while cooperating fully with their ongoing investigation.

Remaining transparent with your insurer throughout this process is vital as it helps maintain trust between both parties involved. Providing accurate and truthful information will ensure fairness in resolving any issues regarding your claim cancellation.

It’s essential to be aware of timeliness and deadlines when canceling an insurance claim under investigation, as there might be specific time frames within which you need to take action before certain consequences come into effect.

Canceling an insurance claim under investigation can affect future coverage and premiums. Insurance companies may view such cancellations unfavorably, and this could result in a

Explanation of Insurance Policy Claim Under Investigation

Insurance claims are investigated for various reasons, all aimed at ensuring fairness and accuracy in the claims process. One of the main reasons for investigation is to prevent insurance fraud. Unfortunately, there are individuals who try to take advantage of their insurance policies by submitting false or exaggerated claims. Investigating these claims helps weed out fraudulent activity and protect honest policyholders.

Another reason for investigating insurance claims is to determine liability. In cases where multiple parties may be involved, such as car accidents or property damage incidents, it’s important to establish who should be held responsible for the damages. This requires gathering evidence and interviewing involved parties to get a clear picture of what happened.

Insurance adjusters play a crucial role in the investigation process. They are trained professionals who assess the validity of each claim based on available evidence and information. Their job includes gathering and preparing evidence, conducting interviews with witnesses or those involved in the incident, and evaluating any relevant documentation.

During an investigation, certain circumstances may arise that allow for a claim cancellation. For example, if there is clear evidence of error or new information comes to light that changes the situation significantly, canceling the claim might be considered.

Eye witness accounts can also play a significant role in determining whether an insurance claim should be canceled under investigation. Eyewitnesses can provide valuable insights into what actually occurred during an incident and help validate or disprove certain aspects of a claim.

Understanding why insurance claims are investigated is essential when considering canceling a claim under investigation. It’s important to cooperate fully with your insurer throughout the process while remaining transparent about any new information that might affect your claim’s status.

Insurance Fraud Prevention

Insurance fraud is a serious issue that affects both insurance companies and policyholders. It occurs when someone intentionally deceives an insurance company to receive financial benefits they are not entitled to. To combat this, insurance companies have implemented various measures for fraud prevention.

One of the key strategies used in preventing insurance fraud is a thorough investigation. Insurance claims are carefully examined to identify any suspicious patterns or discrepancies. This can include reviewing medical records, conducting background checks, and verifying the validity of documents submitted.

Data analysis plays a crucial role as well. Advanced algorithms are employed to detect fraudulent activities by analyzing large amounts of data from multiple sources. These systems can flag potential red flags such as inconsistent information or excessive claims.

Furthermore, collaboration between insurers and law enforcement agencies has effectively reduced insurance fraud. Sharing information and resources helps identify repeat offenders and dismantle organized crime networks involved in fraudulent activities.

Education also plays a vital role in preventing insurance fraud. Insurance companies provide training programs for employees to recognize signs of potential fraud during claim processing. Additionally, public awareness campaigns help policyholders understand the consequences of committing insurance fraud.

Robust measures like investigation, data analysis, collaboration with law enforcement agencies, and education are essential components in deterring and combating insurance fraud effectively.

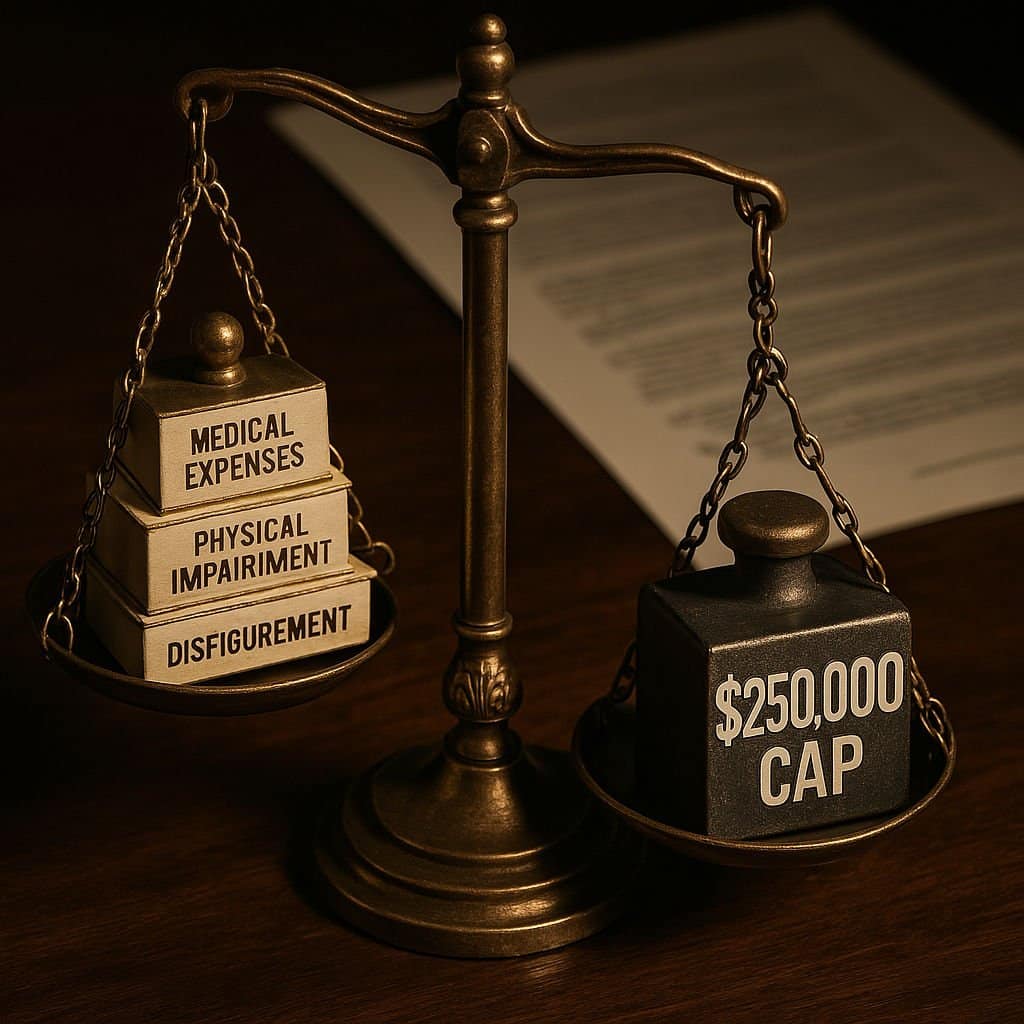

Determining Liability

Determining liability is a crucial aspect of any insurance claim investigation. When an accident occurs, it is important to establish who is at fault and responsible for the damages. This step helps insurance companies determine whether they should pay out a claim or if someone else should be held accountable.

Insurance adjusters play a key role in this process. They gather evidence from the accident scene, review police reports, and interview all involved parties to piece together what happened. Their goal is to accurately assign blame based on the available information.

Eyewitness accounts can also play a significant role in determining liability. These testimonies provide valuable insight into how the accident unfolded and help corroborate other evidence gathered during the investigation.

Determining liability requires careful analysis of all available evidence. It’s not always black and white, as there may be multiple factors contributing to an accident. Insurance companies rely on this information to make fair decisions about claims payouts.

Remember that each case is unique, so it’s essential to cooperate with your insurance company throughout the investigative process. Being transparent and providing relevant information will help ensure a thorough examination of liability in your claim.

The Role of Insurance Adjusters in the Investigation Process

When it comes to investigating insurance claims, insurance adjusters play a crucial role. These professionals are tasked with gathering and evaluating evidence to determine the validity of a claim. Their main objective is to ensure that the claimant receives fair compensation while also protecting the interests of the insurance company.

Insurance adjusters have extensive knowledge of insurance policies and regulations, allowing them to thoroughly analyze each claim. They review documents such as police reports, medical records, and witness statements to get a comprehensive understanding of what transpired during an incident.

In addition to reviewing documentation, insurance adjusters may also interview involved parties. This could include speaking with policyholders, witnesses, or even experts in specific fields relevant to the claim. By doing so, they can gather additional information and perspectives contributing to their investigation.

Once all necessary evidence has been collected, insurance adjusters carefully evaluate it before making a determination on liability. They consider factors such as negligence or fault in order to determine who should be held responsible for damages or injuries resulting from an accident.

It’s important for these professionals to remain impartial throughout the investigation process. While their goal is ultimately reaching a fair resolution for both parties involved in the claim, they must base their decisions solely on the evidence presented rather than personal bias.

Insurance adjusters serve as vital intermediaries between policyholders and insurers during claims investigations. Their expertise allows them to navigate complex situations efficiently while ensuring fairness for all parties involved.

Gathering and Preparing Evidence

Gathering and preparing evidence is a crucial step in the investigation process of an insurance claim. Insurance companies need to collect as much information as possible to determine the validity of a claim and assess liability accurately.

To gather evidence, insurance adjusters may review police reports, medical records, and any available photographs or videos from the accident scene. They may also interview witnesses, including drivers, passengers, and bystanders who witnessed the incident.

In addition to these traditional methods, technology has provided new avenues for gathering evidence. For example, black box data from vehicles can provide valuable insights into factors such as speed and braking patterns at the time of an accident.

Once all relevant evidence is collected, it needs to be carefully organized and prepared for analysis. This involves creating detailed reports that outline the findings from each piece of evidence gathered. These reports are essential in helping insurers make informed decisions about claim settlement or further investigation.

Overall, careful attention must be given to every aspect of gathering and preparing evidence to ensure transparency and accuracy throughout the investigation process

Interviewing Involved Parties

When it comes to investigating an insurance claim, one crucial step is interviewing the involved parties. This allows the insurance company to gather firsthand accounts of what happened and obtain additional information that may be relevant to the case.

During these interviews, insurance adjusters play a key role. They will ask specific questions about the incident, trying to piece together a clear understanding of what occurred. The goal is to uncover any discrepancies or inconsistencies in the statements provided by those involved.

Interviewing witnesses is also vital in gathering evidence for an insurance claim under investigation. Eyewitness accounts can provide valuable insights into how the accident unfolded and who may be at fault.

These interviews must be conducted with sensitivity and professionalism, as emotions can run high after an accident. It’s important for all parties involved to feel comfortable sharing their side of the story without fear of judgment or bias.

By conducting thorough interviews with all involved parties, insurers can gain a comprehensive view of events leading up to and following an accident. This aids in making informed decisions regarding liability and potential settlements.

Interviewing involved parties is a critical part of an insurance claim investigation process as it helps gather essential information needed for accurate decision-making.

Circumstances Allowing Claim CancellationCircumstances allowing claim cancellation can vary depending on the specific insurance policy and the nature of the investigation. In some cases, clear evidence of error or new evidence that changes the situation may warrant a claim cancellation. For example, if an initial accident report was found to contain inaccurate information that significantly impacts liability determination, it may be grounds for canceling the claim.

Eye witness accounts can also be crucial in determining whether a claim should be canceled. If credible witnesses come forward with conflicting testimonies or provide evidence contradicting the original claims made by involved parties, it may prompt further investigation and potentially lead to a claim cancellation.

It’s important to note that insurance companies have specific guidelines and protocols in place regarding when and how claims can be canceled under investigation. This is why contacting your insurance company as soon as possible and providing any relevant information is crucial during this process.

Cooperating fully with the investigation is essential to ensure transparency with your insurance company. Failing to cooperate or withhold information could negatively impact your ability to cancel a claim under investigation.

Remember, every situation is unique, so it’s best to consult with your insurance provider directly for guidance on canceling an insurance claim under investigation based on your specific circumstances.

Clear Evidence of Error, New Evidence That Changes the Situation

Clear evidence of error or new evidence that changes the situation can be crucial in the process to cancel an insurance claim under investigation. When it comes to claims, accuracy is key. Mistakes happen, and sometimes, new information arises that completely alters the incident’s circumstances. In these cases, it is important to gather all relevant evidence and present it to the insurance company.

Errors can range from simple clerical mistakes on paperwork to more significant discrepancies in witness statements or accident reports. These errors can significantly impact the outcome of an investigation and potentially lead to a claim being canceled.

New evidence, on the other hand, may come to light during the investigation process or even after it has concluded. This could be in the form of surveillance footage that was previously overlooked, additional eyewitness accounts that were not initially provided, or even expert opinions that shed new light on the situation.

It is essential for policyholders who believe there may be clear evidence of error or new evidence arising to promptly notify their insurance company about these developments. Providing this information as soon as possible allows for a thorough reevaluation of the claim and increases your chances of successfully canceling it if necessary.

Cooperating with your insurer during this process is vital. Being transparent about any errors or newly discovered evidence demonstrates your commitment to resolving any inaccuracies in your original claim submission.

Remember that timeliness is critical when canceling a claim under investigation due to clear errors or new evidence. Insurance companies often have specific deadlines for submitting cancellation requests related to ongoing investigations. Failing to meet these deadlines may result in forfeiture of cancellation rights and potential ramifications down the line.

While canceling a claim under investigation may provide relief from potential negative outcomes associated with fraudulent activity or inaccurate representations, there are consequences worth considering too.

Canceling an insurance claim could impact future coverage options and premiums since insurers take into account previous claims history when determining rates and eligibility for coverage extensions.

Additionally,cancelled claims might raise red flags for future insurance applications as insurers may view this action unfavorably.

Eye Witness Accounts

Eye witness accounts play a crucial role in the investigation of insurance claims. When an accident occurs, witnesses who were present at the scene can provide valuable information and insights into what happened. These individuals may have seen the events unfold firsthand and can offer their perspective on the sequence of events, the actions of those involved, and any factors that may have contributed to the incident.

The testimony of eye witnesses is considered highly reliable as it comes from unbiased observers who were not directly involved in the accident. Insurance adjusters often rely on these accounts to help determine liability and assess the validity of a claim. Witness statements can corroborate or contradict other evidence gathered during an investigation, providing additional clarity and context.

It is important for individuals involved in accidents to gather contact information from any potential witnesses at the scene. This allows insurance companies to reach out to them later for their account of what transpired. Eye witness accounts can help support or challenge different aspects of a claim, potentially influencing its outcome.

However, it is worth noting that not all eye witness accounts are created equal. Factors such as distance from the incident, visibility conditions, personal biases, or inconsistencies with other evidence could affect their reliability. Therefore, insurance companies typically evaluate multiple witness testimonies alongside other pieces of evidence before making conclusions about a claim.

In summary,s-eye witness accounts hold significant weight in insurance claim investigations.

They provide objective perspectives on accidents that occurred,making them invaluable assets when determining liability.

Due diligence should be exercised when obtaining these testimonies,and they should be evaluated carefully along with other forms o

Required Steps To Cancel an Insurance Claim Under Investigation

To cancel an insurance claim under investigation can be a complex process, but understanding the steps involved can help make it easier. The first step is to contact your insurance company and notify them of your intention to cancel the claim. This can typically be done through phone, email, or in writing.

When contacting your insurance company, it’s important to provide them with all relevant information regarding the claim. This may include any new evidence that has come to light or errors that were made during the initial investigation.

Cooperating fully with the investigation is crucial during this process. It’s important to remain transparent and provide any requested documentation or statements promptly. This will help ensure a smooth cancellation process and maintain trust between you and your insurance company.

It’s also important to be aware of any timelines and deadlines associated with canceling a claim under investigation. Insurance companies often have specific timeframes within which they allow claims to be canceled, so it’s essential to adhere to these guidelines.

The result from cancel an insurance claim under investigation can have consequences for future coverage. Depending on the circumstances, canceling a claim may result in increased premiums or negative effects on your claims history.

Additionally, there are legal and regulatory considerations when you cancel an insurance claim under investigation. It’s important to comply with insurance laws and regulations in order to avoid any potential penalties or legal issues.

Canceling an insurance claim under investigation requires contacting your insurer, providing relevant information, cooperating fully with the investigation process, being mindful of timeliness and deadlines, considering potential consequences for future coverage, as well as ensuring compliance with applicable laws and regulations

Contacting the Insurance Company and Notification Methods

When it comes to canceling an insurance claim under investigation, one of the crucial steps is contacting the insurance company and notifying them about your intention. It’s essential to understand that communication with your insurer plays a significant role in this process.

So, how should you go about contacting the insurance company? Well, there are several notification methods available. The most common method is calling their customer service hotline or reaching out to your assigned claims adjuster directly. In some cases, you might also have the option to notify them through email or an online portal.

When making contact, be sure to provide all relevant information regarding your claim cancellation request. This includes details such as policy number, accident date and location, involved parties’ names and contact information, and any other pertinent documents or evidence you may have gathered.

Cooperating fully with the investigation is also vital during this stage. Your insurer will likely require additional information from you to aid in their assessment of whether cancellation is warranted. Remember that transparency throughout this process can help facilitate a smoother resolution.

It’s important to be mindful of timeliness when contacting your insurance company for claim cancellation purposes. There may be specific deadlines within which you must initiate this request. Failing to meet these deadlines could result in complications down the line.

While the result of cancel an insurance claim under investigation can sometimes seem like a viable solution, it’s crucial to understand that doing so might have consequences for future coverage and premiums. Furthermore, there may be legal and regulatory considerations surrounding claim cancellations that need careful attention.

In summary (not conclusive), taking prompt action by contacting your insurance company using appropriate notification methods and providing all necessary information will set things in motion if you decide on canceling an insurance claim under investigation.

Providing Relevant Information

When it comes to canceling an insurance claim under investigation, providing relevant information is crucial. Insurance companies rely on accurate and detailed information to make informed decisions about the validity of a claim. By providing relevant information, you can help expedite the investigation process and potentially resolve the matter more efficiently.

Gather all documents related to your claim, such as police reports or medical records. These documents provide essential evidence for the insurance company to assess your case accurately. Make sure you submit copies rather than original documents as they might be needed later in legal proceedings.

Clearly communicate any updates or changes regarding your situation promptly. This includes sharing new documentation or witness statements that may support your claim cancellation request. Timeliness is key in ensuring that all relevant information reaches the insurance company within their specified deadlines.

Furthermore, be transparent with the insurance company throughout the investigation process. Honesty and openness build trust between both parties and increase the likelihood of a fair resolution. Concealing or manipulating facts can lead to severe consequences if discovered later on.

Follow any specific instructions provided by your insurance company regarding documentation submission or communication methods. Different insurers may have different protocols in place, so it’s important to adhere to their guidelines.

Remember that providing relevant information not only helps with canceling an insurance claim but also demonstrates your cooperation and willingness to assist in resolving matters swiftly and fairly

Investigation Cooperation

Investigation cooperation is a crucial aspect when it comes to canceling an insurance claim under investigation. It involves actively collaborating with the insurance company and providing them with any relevant information they may require. This includes sharing details about the incident, submitting necessary documents, and participating in interviews or examinations.

By cooperating fully during the investigation process, you demonstrate your willingness to assist in resolving the matter accurately and efficiently. This level of transparency can help build trust between you and the insurance company, potentially leading to a smoother resolution.

Keep in mind that withholding or providing false information can have serious consequences. It may not only jeopardize your claim but also lead to legal repercussions. Therefore, it is essential to be honest and forthcoming throughout the investigation.

Remember that timeliness is key during this process. Respond promptly to any requests made by the insurance company, as delays could prolong the investigation unnecessarily.

Cooperation plays a vital role when canceling an insurance claim under investigation. By actively participating and being transparent throughout this process, you increase your chances of reaching a favorable outcome while maintaining compliance with legal requirements

Why Remaining Transparent With the Insurance Company Is Important

Remaining transparent with the insurance company is crucial when it comes to canceling an insurance claim under investigation. Transparency means providing all relevant information about the incident and cooperating fully with the investigation process.

By being open and honest, you demonstrate your willingness to work together in resolving the claim. It helps build trust between you and the insurance company, which can lead to a smoother cancellation process.

When you are transparent, you help ensure that any errors or misunderstandings are addressed promptly. This can prevent unnecessary delays or complications in canceling the claim.

Moreover, transparency also allows the insurance adjusters to gather accurate information and assess liability accurately. They need all relevant facts to make fair decisions regarding your claim.

Remember that insurance companies have resources for investigating claims thoroughly. If they discover any discrepancies or inconsistencies during their investigation, it could negatively impact your ability to cancel the claim successfully.

Therefore, by remaining transparent throughout the process, you increase your chances of a successful cancellation while maintaining a positive relationship with your insurer.

Timeliness and Deadlines; Deadlines for Canceling an Insurance Claim Investigation

Timeliness is a crucial factor when it comes to canceling an insurance policy claim under investigation. Insurance companies often impose specific deadlines for canceling a claim, and it’s essential to be aware of these timelines to avoid any potential complications.

When you decide to cancel a claim under investigation, contacting your insurance company promptly is vital. Reach out to them as soon as possible using the appropriate notification methods provided by your insurer. This could include calling their customer service line or submitting a cancellation request through their website.

In addition to timely communication, providing relevant information about your decision is equally important. Clearly explain why you wish to cancel the claim and provide any supporting evidence if available. By being transparent with the insurance company, you can ensure that all parties involved are on the same page.

Cooperating with the ongoing investigation while pursuing cancellation is also necessary. It’s crucial not to hinder or obstruct the investigation process in any way. Answer questions truthfully and provide any requested documents or statements promptly.

Understanding and adhering to deadlines set by your insurance company for canceling a claim is essential. Failure to meet these deadlines may result in complications such as denial of cancellation or loss of coverage options for future claims.

Keep in mind that cancelling an insurance claim under investigation may have consequences on your future coverage and claims history. It’s possible that this action could lead to increased premiums or even affect your eligibility for certain types of coverage down the line.

Always consider legal and regulatory considerations when deciding whether or not to cancel an insurance claim under investigation. Compliance with relevant laws and regulations is crucial, as failure to do so can result in further complications and potential legal ramifications.

Understanding timeliness and deadlines when cancelling an insurance claim under investigation is key in navigating this complex process successfully without adverse effects on future coverage options or legal repercussions

Consequences of Canceling an Insurance Claim Under Investigation

Canceling an insurance claim under investigation can have significant consequences that may impact your future coverage and claims history. It is important to understand these potential ramifications before making a decision.

Canceling a claim under investigation could affect your ability to receive coverage in the future. Insurance companies may view this as suspicious behavior or an attempt to hide information. As a result, they may be hesitant to provide you with coverage or charge higher premiums due to perceived risk.

Additionally, canceling an insurance claim under investigation could lead to a possible increase in premium rates. Insurance companies rely on claims history when determining premiums, and canceling a claim might be seen as unfavorable behavior. This could result in higher rates for your policy renewal or when seeking new coverage elsewhere.

Furthermore, legal and regulatory considerations should also be taken into account before canceling an insurance claim under investigation. Compliance with insurance laws and regulations is essential, and cancelling a claim without proper justification could potentially violate these rules. This can lead to penalties or other legal consequences.

It is crucial to carefully consider the implications of canceling an insurance claim under investigation. The potential consequences include difficulties obtaining future coverage, increased premium rates, and adherence to legal obligations within the industry. Before taking any action, it’s advisable to consult with professionals who can provide guidance specific to your situation

Impact on Future Coverage, Possible Premium Increase, and Effects on Claims History

Impact on Future Coverage

Canceling an insurance claim under investigation can have significant consequences for your future coverage. Insurance companies may view this action as a red flag, raising concerns about your credibility and trustworthiness as a policyholder.

Possible Premium Increase

One of the potential effects of canceling an insurance claim under investigation is the possibility of a premium increase. Insurance providers base their premiums on various factors, including the number and severity of claims filed by an individual. Canceling a claim midway through investigation could signal to insurers that you are trying to avoid paying or that you have something to hide, leading them to reassess your risk profile and potentially raise your premiums.

Effects on Claims History

Your claims history plays a crucial role in determining future coverage and rates. When you cancel an insurance claim under investigation, it becomes part of your claims history record. This record is often reviewed by insurers when assessing risk and setting rates for policies. Multiple canceled claims could negatively impact your ability to secure affordable coverage in the future.

It’s important to remember that each insurance company has its own policies regarding canceled claims under investigation, so it’s essential to familiarize yourself with the terms and conditions outlined in your policy. Being transparent with your insurer throughout the process can help mitigate some negative impacts on future coverage.

Legal and regulatory considerations, compliance with insurance laws and regulations, ramifications of canceling a claim under investigation

Legal and regulatory considerations play a crucial role when it comes to canceling an insurance claim under investigation. Insurance companies have a responsibility to comply with insurance laws and regulations, which are designed to protect both the insured party and the insurer. Cancelling a claim without proper justification or following the established procedures can have serious ramifications.

Insurance laws vary by state, so it’s important to understand the specific regulations in your area. In Oklahoma, for example, there are rules governing how claims must be handled and investigated. Failing to adhere to these guidelines can result in legal consequences for the insurance company.

Canceling a claim under investigation should only be done if there is clear evidence of error or new evidence that changes the situation. It’s not something that should be taken lightly or used as a way to avoid liability. Insurance fraud is also taken very seriously, so any attempts to deceive or manipulate the system can result in criminal charges.

When considering cancelling an insurance claim under investigation, it’s essential to consult with legal professionals who specialize in insurance law. They can provide guidance on whether cancellation is appropriate and help navigate any potential legal issues.

Canceling an insurance claim under investigation involves complex legal considerations that must be carefully addressed. Compliance with insurance laws and regulations is paramount throughout this process to ensure fair treatment for all parties involved.

Summary of Whether You Could Cancel an Insurance Claim Under Investigation

Canceling an insurance claim under investigation is a complex process that requires careful consideration and adherence to legal requirements. It is important to understand the steps involved in canceling a claim, as well as the potential consequences that may arise from doing so.

Insurance claim investigations are conducted for various reasons, including fraud prevention and determining liability. Insurance adjusters play a crucial role in gathering evidence and interviewing parties involved in the incident. In some cases, clear evidence of error or new information may emerge during the investigation, prompting the possibility of canceling the claim.

To cancel an insurance claim under investigation, it is necessary to contact your insurance company promptly. This can be done through various notification methods specified by your insurer. When communicating with your insurer, it is essential to provide all relevant information regarding the cancellation request and cooperate fully with their ongoing investigation.

Remaining transparent throughout this process is vital since any attempt to conceal information or mislead the insurance company could have severe ramifications. Timeliness is also critical when canceling a claim under investigation; there are specific deadlines imposed by insurers for initiating cancellation requests.

Canceling an insurance claim under investigation can have several consequences. It may impact future coverage options as insurers consider claims history when providing coverage quotes. Additionally, there might be possible premium increases due to canceled claims being viewed unfavorably by insurers.

It’s worth noting that canceling a claim must comply with applicable laws and regulations governing insurance practices within your jurisdiction. Failure to do so could result in legal repercussions or penalties.

In conclusion (without using “in conclusion”), understanding how to navigate through cancelation processes for insurance claims under investigation empowers policyholders with knowledge about their rights and responsibilities throughout this challenging situation.

By staying informed about these processes and working closely with their insurer during investigations, policyholders can ensure transparency while safeguarding their interests efficiently. Navigating through these intricate procedures requires thorough communication, timeliness, and adherence to legal and regulatory requirements.

Free Consultation with The Wreck Man on Personal Injury Lawsuit

Contact The Wreck Man at 888-2-WRECKMAN to ensure your rights are protected and you receive maximum compensation for your injuries.

Can I Cancel an Insurance Claim Under Investigation in Oklahoma?

The Wreck Man expedites settlement and case closure and minimizes case expenses to ensure clients receive the maximum amount of compensation for their injuries, medical expenses, lost wages, property damages, and pain and suffering.

Famously known as “The Wreck Man,” personal injury attorney Dan Moore has been “wrecking” insurance companies on behalf of car & truck accident victims, for over 12 years, championing “the injured” against major corporations and big insurance companies who regularly deny their claims and legal rights.

Can I Cancel an Insurance Claim Under Investigation in Texas?

The Wreck Man wrecks insurance companies and their effort to settle your case for far less than you may be due in compensation. Today, Dan Moore has his own office building in downtown Carrollton, TX and handles big accident cases for a variety of clients all over Texas. The experienced and competent accident attorneys at Dan Moore Law share Dan’s mission of helping injured Texans and Oklahomans get the money they deserve from those who were at fault and their insurance carriers.