You may wonder how to sue State Farm Insurance in Oklahoma on a car accident case. Let’s discover this topic with Dan The Wreck Man.

State Farm Mutual Automobile Insurance Company, known as State Farm, is the leading automobile insurance company in the United States and is one of the largest Fortune 500 companies in the USA.

State Farm has an estimated 44 million auto insurance policies currently in force and provides automobile owners a variety of auto coverage options in Oklahoma.

A sample of a few of the many automobile insurance policies State Farm offers its Oklahoma customers includes:

- Commercial and residential liability insurance

- Small business insurance

- Motorcycle insurance

- Boat insurance

- Motorhome insurance

- Off-road vehicle insurance

- Teen driver auto coverage

- Rental car coverage

- Sports car coverage

- Commercial auto coverage

- Classic and antique car coverage

State Farm’s mission to its shareholders is to create shareholder value by making an annual operating profit through earning more money through monthly premiums than it pays out to its premium holders for their insurance claims. One way that State Farm and other insurers remains profitable is by training its claims adjusters to use tactics to decrease insurance claim values.

By reducing the value of a claim, State Farm is required to pay less claims payouts. While this may be beneficial for the insurance company, it often has a negative impact on accident victims who are injured or have sustained property damage by drivers holding State Farm auto insurance policies.

A huge company like State Farm is very difficult to deal with. But don’t worry, claimants don’t have to deal with a large insurance company like State Farm by themselves.

The expert automobile accident lawyers at Dan The Wreck Man have successfully won hundreds of lawsuits against State Farm for bad faith claims practices and The Wreck Man consistently wrecks State Farm for their clients. Dan The Wreck Man has office locations in Texas, and Oklahoma, and has represented injured auto accident clients throughout Texas and Oklahoma for years.

Types Of State Farm Auto Insurance Coverage

If you’ve been injured in a car accident caused by a driver in Oklahoma who is a State Farm auto insurance policy holder, you’ll likely want to know what damages and injuries will be covered by their policy. You’ll also want to find out how much your personal injury claim is worth and whether the at-fault driver’s policy will cover at least that amount. The actual amount State Farm will payout for your injuries and other damages is purely reliant on the type of coverage and policy limits the at-fault driver has with State Farm. The common types of auto insurance coverage provided by State Farm include:

Collision Insurance

Collision insurance offered by State Farm covers damage to the policy holder’s vehicle that has occurred as a result of a collision with another car or object. It also provides coverage if the vehicle rolls over and incurs damage. Examples of coverage provided by collision insurance include paying for car repairs and replacements.

Comprehensive Coverage

Comprehensive coverage is another type of coverage offered by State Farm. This coverage provides compensation for vehicles that are stolen or damaged in a way other than in an auto accident or rolling over. It also covers windshield repairs and glass damage.

Personal Injury Protection Coverage

This type of coverage, also known as PIP coverage, offers compensation for lost income and medical costs incurred as the result of an auto accident. In many states, PIP coverage is a mandatory component of auto insurance. However, in some states it is optional.

Understanding the various types of coverages is important when filing a claim with State Farm. However, you don’t have to do it alone, and working to understand these forms of coverage can be difficult following a traumatic auto accident. Working with an expert attorney will make it easier to ensure you are aware of the coverage the at-fault driver has and the compensation you are eligible to receive.

How to Negotiate a Car Accident Claim With State Farm

Following a car accident, you will likely have to deal with State Farm Insurance and their adjusters. These company adjusters are trained to offer you a lowball offer in hopes that you accept it without negotiation. These offers, however, may not be enough to pay for your physical injuries, emotional distress, or property damage.

If you have been recently injured in a car accident in Oklahoma, we can help negotiate with insurance companies on your behalf. Call Dan The Wreck Man at 888-2-WRECKMAN for your 100% free consultation. You will not pay us anything unless we are successful in winning your case.

How to Negotiate a Car Accident Settlement

Negotiating with insurance companies can be difficult and time consuming. You may try the following negotiation tips a car accident settlement, as seen below:

1. Initiate a claim as soon as possible after the accident

The first step in negotiating a car accident settlement is to contact the insurance company as soon as possible following the incident to initiate a claim. By initiating your claim as quickly as possible, your vehicle may be able to be repaired faster. Although you will need to provide your insurance company with certain information, such as the time and date of the accident, never make a recorded statement regarding fault until you have spoken to an attorney.

2. Keep accurate records

You should also keep and maintain a file of records in relation to your car accident. This includes the police accident report, any medical records documenting your injuries, vehicle repair costs, and all other records that may be relevant to the incident. These documents will be necessary when discussing settlement amounts.

3. Determine a fair settlement amount

Before sending your insurance company a demand letter, you should first determine what you believe is a fair settlement amount for your claim. To calculate a fair settlement, you should take into account a variety of factors, including your past and future medical costs, loss of income, pain and suffering, and property damage.

4. Send the insurance company a demand letter

After deciding on an acceptable settlement figure, you should send a demand letter to your insurance company. This letter should contain how much money you demand because of your accident. Your demand should include medical receipts, car mechanic bills, and related proof of expenditures. Further, this demand should not be the lowest amount of money you will accept, as you will likely be negotiating with your insurance company and will need space to be flexible.

5. Never accept the first offer

Insurance companies stay in business by paying as little as possible for claims. Thus, the first offer an insurance adjuster will make will likely be too low. Never accept an initial offer that you believe is too low. Instead, you should negotiate and make a fair counteroffer.

Hire an attorney with experience in handling insurance companies like State Farm

To get a fair settlement amount, it may be necessary to hire an attorney with experience in negotiating with insurance companies. The right attorney can help investigate your case, determine what a fair settlement is, and negotiate on your behalf.

Need help? Contact Dan the Wreck Man today. 888-2-WRECKMAN.

FAQs for Negotiations with State Farm Adjusters

Often asked questions regarding negotiations and counter offers with a State Farm Insurance adjuster’s claim settlement offers to maximize your car insurance claim settlement.

How do you counter adjuster offers for a car accident settlement?

In most situations, the insurance companies will offer you low settlement amounts in hopes that you will accept it and not negotiate. It is important to remember, however, that you are not obligated to accept this amount. In fact, you should always plan on countering the first settlement amount insurance companies give you.

To counteroffer successfully, it is important to first understand what you believe your case is worth. This may be based on a variety of factors, including medical costs, loss of income, and your pain and suffering. You must be able to take this evidence and use it to explain why the insurance company’s offer was unacceptable.

Next, you will need to physically draft a letter as a counteroffer. You will likely want to attach the above-mentioned evidence in the form of bills and receipts to support your position. You will also need to present your preferred amount for the settlement. You will then submit this letter to your claims representative.

Drafting a counteroffer may be challenging without the proper legal guidance. For this reason, Dan The Wreck Man attorneys are available 24/7 to discuss your claim and help you present a fair counteroffer.

How can I maximize my car insurance claim amount?

There are several things you can do to help maximize your insurance claim, such as:

Gather evidence:

When making a claim for your car accident, you need as much evidence as possible in order to help prove your case and to receive fair compensation based on the damage you suffered, both physically and on your car.

It is important to take pictures of the accident scene, all cars involved, and any injuries that you sustained. Pictures are very important to take right away, especially injuries, as they can heal quickly.

At the scene, it is also helpful to talk with any witnesses who can back up your claim to the accident. Witnesses may have been able to observe part of the accident that you forgot or didn’t notice. If there were police officers involved, it is also very important to keep records of their report as another reliable witness to your claim.

Acknowledging your surroundings during the time of the accident are also crucial. For instance, you should take note of the road or weather conditions at the time of the accident or if the other driver seemed intoxicated.

One set of important documents to keep on file are all medical bills. This is crucial for the attorneys to use to prove your case and to show to the court that the pain caused during the accident was real and you were left to pay for it. If these medical problems caused you to miss any work, contact your employer to fill out an affidavit that verifies your claim of injury and inability to work because of the accident.

Know the terms of your insurance policy:

Another important facet of negotiating a claim is to have a good understanding of your current car and health insurances. Knowing how much that your policies covered on these accidents is crucial when desiring a reimbursement in the settlement.

When negotiating the claim, it is suggested to double or triple your expenses that you made because of the accident, as there are chances to receive more or less money depending on the specific case; your attorney will be able to help you work out these numbers more accurately.

When negotiating a car accident claim, it is key to remember all of the details, keep all of the evidence you can, and be prepared with adequate information on your own insurance policies. It is the aim of the attorney to then take these facts and help you sort through them and accurately present your case and help you toward the goal of winning the settlement.

If you have any other questions regarding maximizing your claim or counteroffering lowball settlement amounts, contact Dan The Wreck Man as soon as possible. Our team has ample experience in dealing with insurance companies, and we may be able to help you as well.

Need Help? Contact Dan The Wreck Man Today

Negotiating with insurance companies can be a daunting task, as insurance adjusters are trained to offer you low settlement amounts in hopes you will take the money without a fight. These low amounts, however, may not cover your medical expenses, lost wages, or mechanic bills. In order to receive a fair settlement amount, you may need to contact an experienced personal injury attorney who has experience in negotiating with insurance companies.

State Farm Insurance Claim Tips & Tactics

Here are the settlement negotiation tips and secrets State Farm adjusters don’t want you to know in order to maximize your bodily injury settlement, including answers to frequently asked questions regarding State Farm car accident settlements.

Playing Hardball

State Farm leads the charge in overhauling the handling of auto insurance claims with their internal company philosophy of the Three D’s—DELAY, DENY, DEFEND.

Even when presented with valid claims, they decided to unnecessarily delay the handling of these claims by taking their time in investigating and ultimately determining liability on those that were valid.

They may also deny valid claims, leaving the claimant with the only choice of going to court.

And they may aggressively defend these cases throughout litigation.

What this all meant for State Farm was more time to hold the premiums in their hands so that they could maximize the investment income on this money. What this meant for their insureds and claimants was frustration, wasted time, and countless lawsuits filed.

In a recent 18-month long CNN investigation, it was found that State Farm (along with Allstate) employed a hardball scheme in minor-crash claims, including employing the Three-D’s defense tactic, convincing juries that these claims were fraudulent, and treating claimants unfairly.

Documents CNN obtained in the investigation highlighted that this scheme was purely for profit and was not to crack down on fraud, as State Farm had claimed.

Fighting State Farm’s 3-D’s-Delay, Deny, Defend Strategy

You don’t need to fall victim to State Farm’s strategy to avoid paying or undervaluing your auto accident injury claim. The following 10 tips will help in fighting back and avoid being a casualty to State Farm’s Three-D’s strategy:

1. Get Medical Treatment Immediately

If you’re injured, you need to seek medical treatment as soon as possible. Preferably go to the emergency room by ambulance. Now is not the time to be cheap. Of course, you only want to seek medical treatment if you’re injured. Don’t go faking your injuries. State Farm will find you out (see #7 below).

If you’re not initially in pain immediately after the accident, that doesn’t necessarily mean you’re not injured. When your adrenaline is rushing through your body after an auto accident, many times you are numb to pain. You may wake up the next day or several days later stiff, sore, or with limited range of motion in your back, neck, or limps.

You can go to an emergency room or urgent care later down the road but as time passes, it’ll be more difficult to prove that your injuries were caused by the accident. State Farm certainly gives claimants a hard time if there are substantial gaps in medical treatment. Don’t let this happen. Get to the doctor (this includes the chiropractor)!

2. Do Not Give State Farm A Recorded Statement

State Farm is notorious for asking for a recorded statement from claimants. DO NOT GIVE A RECORDED STATEMENT! There is no requirement under the law that you give a statement to the other driver’s insurance company.

I will preface this by saying do not give a recorded statement to State Farm if they are the insurance carrier of the at-fault party.

If they are your insurer and you’re making a claim under your uninsured/underinsured motorist coverage, PIP, Medical Payments, Collision, or Comprehensive coverages, then you’ll need to talk to them. But be very careful in talking to them. Although they are your insurance company, this is where things become adversarial. It’s probably best in this scenario to discuss your case with a car accident lawyer prior to talking with State Farm.

3. Reject State Farm’s “Nuisance” Offer

A “nuisance” offer is an offer made by an insurance company to quickly settle a case for an absurdly low amount to make the claimant go away. These offers range anywhere from the low hundreds to low thousands. Sometimes they may even offer to pay your emergency room bill or a few visits to the chiropractor, at a reduced amount, of course. Reject these types of offers!

If State Farm is offering you any money for your bodily injury claim, they likely have more to offer, if you can prove your case’s damages to them. By “damages,” I mean medical expenses, lost wages, and any general damages, including pain and suffering.

On many injury claims, specifically those with soft tissue injuries, State Farm assigns the claim to a team. This means State Farm is placing a low value on your case. These team adjusters typically have very low settlement authority and will try to get the case resolved as quickly as possible before the claimant gets a lawyer involved.

Before any offer is accepted in writing or over the phone, make sure you at least talk to a car accident lawyer. They always give free consultations and if you hire one, you will not have to pay them anything up front. They’ll only get paid if they are able to win your case.

One more thing: if you settle your case by signing a release or accepting an offer orally, it will be extremely difficult to get out of it. Remember a settlement is final! Trying to get State Farm to pay you more money after you’ve settled with them will be futile.

4. Know The “Eggshell Skull Plaintiff” Doctrine

State Farm, like the vast majority of insurance companies, ignore this important legal doctrine. Not only do they ignore it, but they attempt to turn the tables on the claimant when it comes to preexisting conditions or injuries.

What is the Eggshell Skull Plaintiff doctrine? It’s a common law (judge created) doctrine that says the defendant takes the plaintiff as he finds him when he makes the plaintiff’s condition worse. This means the negligent defendant is liable for an exacerbation or aggravation of a preexisting injury or condition.

Here’s an example: an at-fault driver causes a minor fender-bender with a little old lady that has bones as brittle as glass and shatters her hip. Here, the at-fault driver is responsible for making the little old lady’s condition worse. It doesn’t matter that this little fender-bender wouldn’t have caused this type of injury to most people.

Another example of this is with a claimant with an asymptomatic (i.e., no symptoms) herniated disc in his lower back that now becomes symptomatic as a result of a careless driver rear-ending him at a red light. It doesn’t matter that the careless driver didn’t cause the herniated disc. All that matters is that the careless driver aggravated a preexisting injury, for which he/she is responsible under the Eggshell Skull Plaintiff doctrine.

State Farm will try to use a preexisting injury or condition against you, claiming that you have failed to establish your case against their driver. They’ll claim that it’s almost impossible to sort out a prior injury from a potentially new or aggravated one. This is not true.

A good place to start in proving an exasperation or aggravation is with your prior medical history. You may be able to provide State Farm with medical records that document the lack of any issues with the particular body part in question. Most people see their primary care physicians at least once a year for a checkup. If you had any complaints, you most certainly would express them to your doctor.

Proving an exacerbation or aggravation to a preexisting injury or condition can get quire complex. So, it’s important to consult with a lawyer before you start sending your prior medical records to State Farm. Keep in mind, you absolutely have no obligation to provide them with your prior medical history. If they do not get your permission by having you sign a medical release before acquiring your medical records on their own, they are violating HIPAA.

You should not provide a signed medical release to the at-fault driver’s insurance company.

5. Know The Factors Affecting Your Case Value

There are many factors that affect the value of an auto accident injury case. Some factors are more important than others, including:

Facts Of Your Case

Obviously, case facts matter. But what facts are most relevant in an auto accident injury case? A few facts include the extent of the property damage of all vehicles involved in the collision; the county where the accident occurred; independent witnesses, and the road conditions. These facts all play into valuation.

The extent of property damage matters because the more property damage, the more likely there are to be serious injuries. The county where the accident occurred matters since State Farm may pay more in a more plaintiff-friendly venue. There being independent witnesses that saw the accident matter when liability is being questioned by State Farm in a word against word accident. And road conditions matter since it may affect how State Farm places fault on each party.

Severity Of Injuries

State Farm pays more money on more serious injuries, as you may have guessed. Soft tissue injuries, such as whiplash, are worth less than a broken bone or fracture. However, keep in mind that just because you have a soft tissue injury doesn’t mean your injuries aren’t serious. Claimants with soft tissue injuries, such as a herniated disc, can recover more than a minimal amount from State Farm. Proper and consistent medical treatment are crucial in these types of cases.

Medical Treatment

As mentioned above, proper and consistent medical treatment is crucial in proving up your injury case. Fundamentally, it is the plaintiff’s burden in proving their case against the defendant. This includes proving their damages. Typically, the largest driver in most personal injury cases is the medical bills. Without proper and consistent medical treatment, you can end up only being offered a nuisance offer, especially if your injuries are not apparent (e.g., soft tissue injuries).

Comparative Fault

Any fault placed on you can be devastating to your claim against State Farm. For example, if they determine that you are 50% at fault for your intersection accident, you have effectively cut your potential maximum compensation in half.

The state in which the accident occurred will determine whether you may be barred from recovering some or all of your damages.

In some states like Arizona and California, you can technically still recover some of your damages even if you’re 99% at fault.

In other states like Florida and Texas, if you are more than 50% at fault for your accident, you are completely barred from recovering any of your damages.

Policy Limits

In many cases against State Farm, your potential compensation will be limited to the amount of the at-fault party’s policy limits.

For example, if the at-fault driver only has a $30,000/$60,000 liability policy, that is the maximum you can receive from State Farm. However, if you have your own underinsured motorist coverage or MedPay/PIP, you may be entitled to more than the State Farm policy limits.

Another important note on State Farm policy limits: If the State Farm insured has a large policy and your injuries are minor (e.g., soft tissue injuries), they will do their best to low-ball you. More on this below.

Insurance Company

An important factor in valuing any auto accident case is knowing who the at-fault party’s insurance company is. Some pay more than others. We’re discussing State Farm here. They are the largest insurance carrier in the United States. That doesn’t mean they are the best quality insurance company though.

If I had to assess their quality, out of the big five insurance companies, I’d put them near dead last. They’re cheap, they use unfair tactics in negotiating claims, they undervalue claims, and they would push every case to litigation if they had their choice.

However, they are not invincible. Every insurance company has an Achilles heel. That Achilles heel is a well-informed claimant, an experienced car accident lawyer, and justice herself. They can’t dodge a lawsuit and avoid paying a judgment. Remember that. The law is on your side in these cases if they are handled correctly.

Aggravating Factor

An aggravating factor is one where the at-fault party acts beyond just regular negligence.

Remember, in a personal injury case based in negligence, all that you must prove is that the defendant failed to meet the reasonable person standard and as a result the plaintiff suffered recognizable damages.

If the defendant acts with either gross negligence or recklessness, both of which are elevated levels of culpability above regular negligence, they may be liable for punitive damages.

Punitive damages are awarded in addition to compensatory damages (e.g., medical expenses, lost wages, pain and suffering) and are intended to punish the defendant for their conduct. In effect, an aggravating factor can increase the value of a claim.

An example of this is an accident that was caused by a drunk driver.

Defendant’s Profile

Who the defendant is matters. If the defendant is a corporation whose driver caused the accident, the corporation will be responsible for the damages under the Respondeat Superior doctrine. Juries and State Farm adjusters tend to award more money to the plaintiff in cases where there is a corporate defendant that caused the accident.

There are two main reasons for this: (1) juries think corporations have deeper pockets to compensate the injured party, and (2) they are less sympathetic to a huge company with tons of assets.

The defendant’s profile is also relevant to value where the defendant has a substantial criminal history or has a bad driving record. The defendant’s background doesn’t usually come into evidence at trial to show the defendant is a bad person or bad driver but may come in as evidence to show their propensity towards truthfulness when testifying. This still has the same effect as it being offered as “bad character” evidence before the jury. In effect, this evidence most likely will increase the value of your claim against State Farm.

6. Negotiate Your Case Properly

You should always start your negotiations with State Farm high—a number that you know they won’t pay, but one based in reality. For example, you don’t want to start negotiations at $500,000 when you have whiplash and only sought medical treatment at a chiropractor. But you don’t want to start off too low either and paint yourself into a corner.

Know the number you would take to settle your claim before you start negotiations. With each round of offers, see if it’ll be beneficial to match the movement of the adjuster as they come up from their previous offer. Also, don’t ever bid against yourself by lowering your offer if the adjuster doesn’t increase their offer. Wait for them to come up before you come down.

Typically, State Farm will low-ball you on their first offer, especially if you are claiming soft tissue injuries. This offer will most likely be based only on medical bills that they have considered reasonable with adjustments for what they claim is usual and customary within your particular geographic location. They will then add in a nominal amount for general damages (e.g., pain and suffering).

Usually, State Farm adjusters will move from their initial offer anywhere from three to five times. If you hit a wall in negotiating, see if you can provide the adjuster with any new information that might give them a reason to increase their offer.

Go over each line item of your medical bills with the adjuster. Ask them how much of each bill they are considering and whether they are considering ALL of your bills. State Farm is notorious for discounting the medical bills based on their arbitrary usual and customary rate.

Remember that adjusters are just people like you and me, performing a job. They have families and bills to pay. Treat them like people. They will not cower down to disrespectful or aggressive negotiation tactics, or foul language. That will get you nowhere. Be kind and firm. Use facts. Don’t bad mouth State Farm to them.

Most State Farm adjusters ultimately have little power and must go through the bureaucratic nonsense that’s required in a large corporation to get more settlement authority on a claim.

You should build a rapport with them. Make them want to help you. Being courteous and professional will more easily get them to their top offer than being belligerent and combative. If you can’t get to a number you think is fair, it’s time to lawyer up!

If you’re dealing with a large policy like $100,000/$300,000 or $250,000/$500,000, and your injuries are minor, expect a fight. State Farm has no incentive to settle your case for top dollar since, even if the case goes to trial, an excess verdict is unlikely. There’s only one thing that insurance companies hate more than paying claims and that is paying above the policy limits as a result of an excess jury verdict.

7. Avoid Special Investigative Unit (If You Can Help It)

The Special Investigative Unit (SIU) is the insurance company’s fraud department. Cases are thrown into SIU when there is suspicion of fraud or impropriety. Usually this is occurs because State Farm thinks the injuries or damages were fraudulent, or the injured party is a serial claimant.

I have seen two types of cases more often go into State Farm SIU. Claims where: (1) the claimant’s statements about facts or injuries that don’t line up with other evidence; or (2) the claimant has treated with a medical provider that is on State Farm’s red flag list. These medical providers overtreat, overcharge, or conduct business unscrupulously according to State Farm.

So, how do you avoid SIU? The best way to avoid SIU is to be 100% honest with the facts that you know and the injuries with which you are certain. This doesn’t mean you need to volunteer information to them or attempt to diagnose your condition to satisfy their demands. But don’t fabricate a story or fake an injury. That’s unethical and it’s a crime. They will find you out.

Sometimes State Farm gets it wrong. They may send a claim to SIU that doesn’t belong there. Ask the adjuster why your claim is in SIU. If it’s something you can remedy, do it. Otherwise, they may severely undervalue your claim or deny your claim altogether.

8. Talk To A Supervisor

State Farm adjusters operate under an organizational hierarchy just as most large corporations, with lower-level employees, middle management, and upper management. The adjusters handling the vast majority of claims at State Farm, especially at the team level, do not have much settlement authority. They must strictly adhere to the adjusting software they use in evaluating claims and stick to the State Farm script in extending offers to settle.

Sometimes you can sidetrack this process by discussing the claim with the assigned adjuster’s supervisor, if you had no luck in negotiating a fair settlement with the assigned adjuster. A State Farm supervisor may be willing to take a second look at the claim to see if the adjuster missed something.

Keep in mind: you may get pushback from the assigned adjuster or their supervisor when requesting a supervisor re-review of your file. They may say the supervisor is not able to add any value to the claim. I would continue to push them. Also, if you have any additional information to give them that may increase the value of your claim, send it to them. This includes additional medical bills, photos of your injuries, photos of pain medication you’ve been prescribed, or how the accident has affected your daily routine or impaired a bodily function.

9. Consult With A Knowledgeable Proven Personal Injury Trial Attorney

Claimants are only doing themselves a huge disservice by trying to handle their car accident injury case on their own. We have taken cases over for clients that tried to handle State Farm on their own countless times. I can tell you it’s never good. Sometimes it’s at a point where it’s too late and they’ve settled their case by signing a release or accepting a State Farm low-ball offer over the phone.

Talk to a personal injury lawyer immediately after a car accident if there are injuries. It’s always free to discuss your case and you won’t have to pay anything unless they win your case.

If you’re hesitating and think you will make more money in your pocket by not hiring a lawyer, that is simply not the case. A study by the Insurance Research Council showed that attorney represented claimants received two to three times more of a settlement than those without a lawyer. Even with taking attorney’s fees into account, you’ll end up with more money in your pocket.

10. File A Lawsuit

If you’ve done everything you can to increase the value of your case by negotiating resolutely, providing the adjuster with evidence of your injuries and all damages, requested to discuss your claim with a supervisor, and provided them with any new information about your case, filing a lawsuit may be the only option.

Preferably at this point you’ve consulted with an attorney and hired him/her to pursue the State Farm insured in court. Many times, the only way to get State Farm to move is to sue their insured and make their attorneys work.

Keep in mind you’ll most likely settle your case once it’s reached the litigation phase since more than 90% of all auto accident cases don’t ever make it to trial.

How Long Does It Take State Farm To Settle?

In our experience, most cases settle in six to twelve months. Of course, this will all depend on how much medical treatment you will need.

Soft tissue injuries usually heal in about six to eight weeks and need about that much time of chiropractic treatment and/or physical therapy.

A broken bone or fracture can take anywhere from six to 20 weeks to heal completely. But you may be able to resolve these types of cases quickly with State Farm since your injuries are apparent, especially if the State Farm bodily injury policy limits is under $100,000/$300,000.

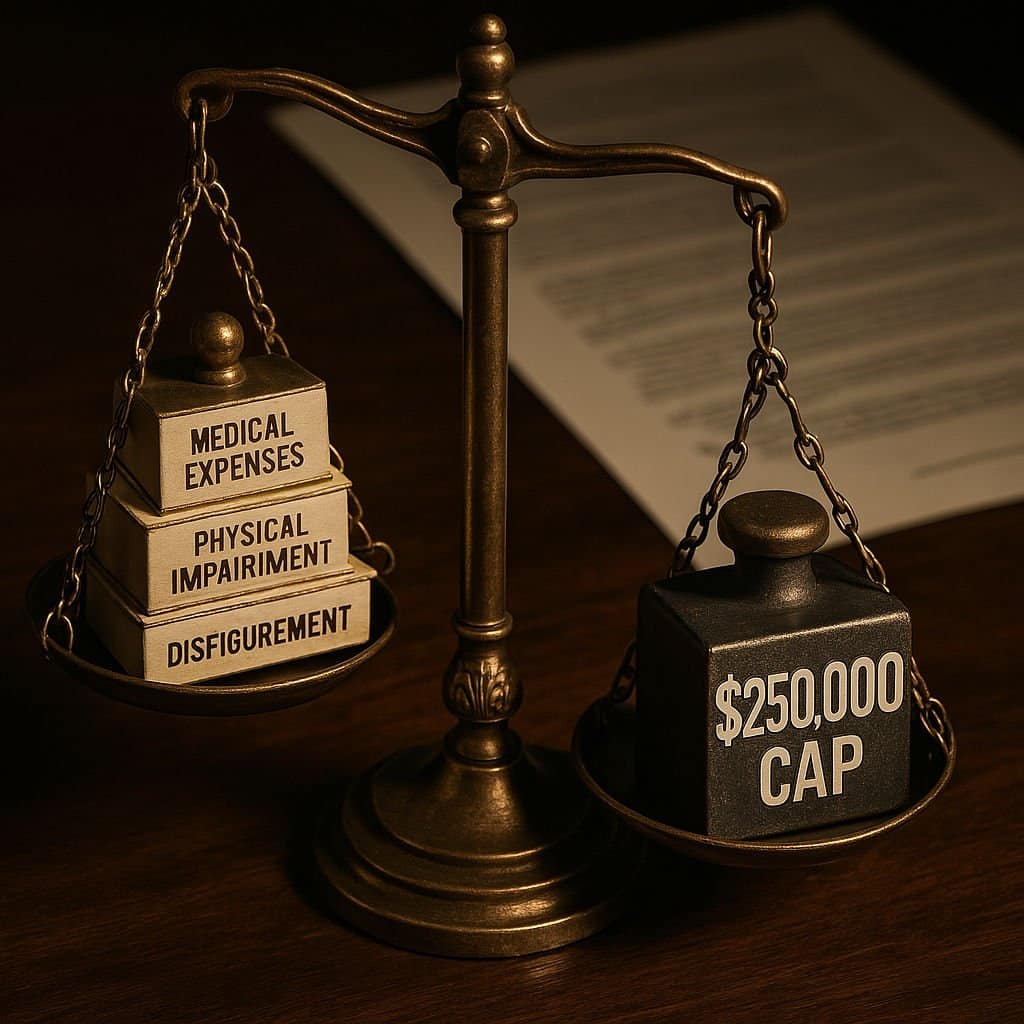

Other more catastrophic injuries or wrongful death cases may be able to resolve immediately with State Farm, assuming liability is clear, and the policy limits are under $250,000/$500,000 or $500,000/$1,000,000. It will depend on the seriousness of the injury, impairment, scarring, and other general damages elements.

How Much Does State Farm Pay for Spinal Injuries?

The value of your spinal injury will depend on the several factors, including the extent of your spinal injury, policy limits, and medical treatment.

The more severe and permanent your injury, the more your claim will be worth. Your claim may be limited by the amount of the State Farm policy limits that the defendant has. Medical treatment is a huge factor in determining how much your case is worth with State Farm. If you need surgery, your case will be worth more than a case where you only sought minimal treatment with a chiropractor.

The most common type of spinal injuries in an auto accident are sprains and strains to the muscles and tendons surrounding the spine. State Farm pays the least on these types of spinal injuries since they are not permanent and usually heal in six to eight weeks with minimal treatment. State Farm can pay anywhere from the low hundreds to several thousands of dollars for back/neck sprains or strains.

Herniated discs are also a common spinal injury in an auto accident. A herniated disc can be worth much more than just a sprains and strains case since this injury is permanent and can be debilitating. These can settle anywhere from the low five-figures to several hundreds of thousands of dollars. The higher end settlements for a herniated disc injury usually involved surgery.

More serious injuries like spinal fractures are obviously worth more than a sprains/strains case and can be worth more than a herniated disc case. However, that will depend on what sort of medical treatment is required and whether there will be any impairment. Surgical cases involving fractures can be worth millions of dollars if the injury is life-altering (e.g., paralysis).

How Does State Farm Calculate Settlement Values?

State Farm uses claim adjustment software to calculate most of their auto accident claims. The basic calculation is to add the medical expenses, lost wages, and general damages (e.g., pain and suffering, emotional distress, etc.) and adjusting for any comparative fault on the claimant.

However, State Farm may reject paying all the medical bills if they don’t think the medical treatment was reasonable or if the provider overcharged for their services.

The calculation of the pain and suffering and other general damages components is less straight forward. Several soft factors will be entered into their software including whether there is any objective proof of pain such as MRI film/reports and photos of the injuries, orthopedic devices, or surgical hardware (e.g., screws, plates, pins).

Is State Farm Good At Paying Out Claims?

Generally, State Farm is very cheap in paying claims, especially with soft tissue injury cases. So, the answer is NO. Out of the top five insurance companies by premiums written (i.e., STATE FARM, Geico, Progressive, Allstate, Liberty Mutual), they are close to last, if not dead last for how good and fast they are at paying claims.

If you want maximum recompense or top dollar on your case with State Farm, you’ll need to file a lawsuit against their insured. Not only do you need to file a lawsuit, but you’ll likely need to go a bit farther in litigation to get fair value for your case. Some insurance companies, and often State Farm, will immediately increase their offer once you file a lawsuit.

State Farm usually doesn’t increase their offer much immediately after the suit is filed and their insured is served with notice of the lawsuit.

Is State Farm Known for Denying Claims?

The short answer to this question is, YES. It’s part of the Three-D’s strategy to Delay, Deny, Defend, as you recall.

There are three main reasons why State Farm would deny a claim: suspected fraud, coverage issues, or it’s a Minor-Impact-Soft-Tissue-Injury claim.

Suspected Fraud

We discussed in detail above in Tip #7 what SIU is and how you can do your best to avoid it. If you get a letter like the one below, call a lawyer immediately. It will be difficult to overcome this on your own.

Coverage Issues

Coverage issue denials occur for several reasons, including:

- Their insured forgot to pay their premiums

- Their insured was doing rideshare without adding a rideshare endorsement to their policy

- The crash was the result of an intentional act (road rage)

- The covered vehicle wasn’t being driven by a permissive user (it was stolen)

Minor-Impact-Soft-Tissue-Injury

M.I.S.T. cases are those where there may be little visible damage to the vehicles involved and the claimant is only claiming soft tissue injuries.

State Farm will argue that there is no way there could be an injury since there is no real damage to the vehicles involved in the crash, and therefore, no “mechanism of injury.” Makes sense, huh? Not really. Human beings get injured in low impact auto accidents all the time and there are studies showing this to be true. State Farm only hopes that when they go to trial on these cases that they can plaster a large photo of the vehicles in front of the jury and argue, “How can there be any injuries here?” So, if you get a letter from State Farm like the one below, call an attorney.

Do I Need A Car Accident Lawyer In My Case Against State Farm?

This will depend on if you have injuries. If you have only minor property damage and aren’t sore, stiff, or have limited range of motion after a sufficient time after your accident, then you likely can handle the case on your own.

But if there is moderate damage to either your vehicle or the other party’s and you are experiencing any symptoms of injury, I would at least get the opinion of a car accident lawyer. It can’t hurt. Every personal injury attorney I’ve ever seen offers FREE consultations and you won’t need to pay them anything up front to start working on your case.

Will My Case Against State Farm Go To Trial?

The odds of your case going to trial are less than 5%. Most cases, even those against State Farm, settle before trial. You may need to file a lawsuit to get fair value for your case but that doesn’t mean you will ever see the inside of a courtroom.

If you were injured in a car accident and are unsure of how to deal with State Farm insurance, call Dan The Wreck Man personal injury attorneys today at (882)-2-WRECKMAN to set up your free initial consultation. You pay nothing unless we win your case and you receive compensation. The Wreck Man has a “No Win, No Fee Guarantee.” Meetings with The Wreck Man attorneys are available by appointment only.