Are you aware of how long an at-fault car accident stays on your Texas insurance record? Understanding the duration of this impact is essential for insurance purposes and can help you plan for the future. In this article, we will unveil the specifics of how long an at-fault accident can affect your insurance rates and coverage in the Lone Star State.

From minor fender benders to more severe collisions, any at-fault accident can have a lingering impact on your insurance record. Texas insurance providers typically consider accidents from the past three to five years when determining rates and coverage options. This means that even a single at-fault accident can affect your premiums and potentially limit your coverage options for several years.

Knowing the duration of an at-fault accident’s impact on your insurance record is crucial for making informed decisions about your coverage and understanding the financial implications. So, let’s dive into the details and shed light on how long you can expect an at-fault accident to stay on your Texas insurance record.

Understanding at-fault car accidents

Car accidents happen every day, and sometimes, we find ourselves at fault for causing them. An at-fault car accident refers to a situation where you are deemed responsible for the collision. It can range from minor fender benders to more severe collisions resulting in extensive damage and injuries. Regardless of the severity, any at-fault accident can have a lingering impact on your insurance record.

How at-fault car accidents affect your insurance record

When it comes to car insurance, your driving history plays a significant role in determining your rates and coverage options. Insurance providers in Texas typically consider accidents from the past three to five years when assessing risk and determining premiums. This means that even a single at-fault accident can affect your insurance rates and potentially limit your coverage options for several years.

An at-fault accident on your record signals to insurance companies that you may present a higher risk of being involved in future accidents. As a result, they adjust your rates accordingly to reflect this increased risk. The impact of an at-fault accident on your insurance record can vary depending on the severity of the accident and the resulting damages. However, it is important to note that insurance providers have their own criteria for evaluating accidents, so the exact impact may vary.

Duration of at-fault car accidents on your insurance record

Now that we understand how at-fault accidents affect your insurance record, let’s explore the duration of this impact. In Texas, an at-fault accident typically stays on your insurance record for three to five years. During this time, insurance companies will consider the accident when determining your rates and coverage options.

It is crucial to note that the duration of the impact can vary depending on the insurance provider and your driving history. Some insurance companies may only look back three years, while others may consider accidents from the past five years. Additionally, if you have multiple at-fault accidents on your record, the impact may be more severe and have a longer duration.

Factors that can prolong the impact of at-fault car accidents

While the general rule of thumb is that an at-fault accident stays on your insurance record for three to five years, certain factors can prolong the impact. These factors include:

- Repeat offenses: If you have multiple at-fault accidents on your record, insurance companies may consider you a higher-risk driver and extend the duration of the impact.

- Severity of the accident: The seriousness of the accident can also impact how long it stays on your record. A minor fender bender may have a shorter duration compared to a major collision resulting in significant property damage and injuries.

- Traffic violations: If you were cited for traffic violations in conjunction with the at-fault accident, such as speeding or running a red light, it can further extend the impact on your insurance record.

- Insurance claims: Making insurance claims for the at-fault accident can also prolong the impact. Insurance companies may view frequent claims as a sign of increased risk and adjust your rates accordingly.

Steps to minimize the impact of at-fault car accidents on your insurance record

While you may not be able to completely erase the impact of an at-fault accident on your insurance record, there are steps you can take to minimize its effects. Here are some strategies to consider:

- Defensive driving courses: Completing a defensive driving course can demonstrate your commitment to improving your driving skills and may earn you a discount on your insurance premiums. Additionally, some insurance providers offer accident forgiveness programs that can help mitigate the impact of an at-fault accident.

- Safe driving habits: Practicing safe driving habits, such as obeying traffic laws, avoiding distractions, and maintaining a safe distance from other vehicles, can reduce the likelihood of future accidents. By demonstrating responsible driving behavior, you can gradually improve your insurance record.

- Consider higher deductibles: Opting for a higher deductible can lower your insurance premiums. However, it is important to assess your financial situation and ensure that you can comfortably afford the deductible in the event of an accident.

- Shop around for quotes: Insurance rates can vary significantly between providers. Take the time to shop around and compare quotes from different insurance companies to find the most competitive rates for your situation.

Importance of reporting at-fault car accidents to your insurance company

Reporting an at-fault car accident to your insurance company is crucial, even if you think the damage is minor or you can handle the costs yourself. Failure to report an accident can have serious consequences, including potential denial of coverage and legal issues. It is always best to be transparent with your insurance provider to ensure that you are properly protected and in compliance with the terms of your policy.

By reporting the at-fault accident, you allow your insurance company to assess the damages, handle any potential claims, and accurately update your insurance record. This transparency also helps establish trust and ensures that your insurance company has the necessary information to provide you with the coverage you need.

Common misconceptions about the duration of at-fault car accidents on your insurance record

There are several common misconceptions surrounding the duration of at-fault car accidents on your insurance record. Let’s address some of these misconceptions to provide clarity on the topic:

- “The accident will disappear from my record after a certain number of years.” While it is true that an at-fault accident may no longer be visible on your driving record after a certain period, insurance companies can still access this information when evaluating your risk and determining your rates.

- “Changing insurance companies will erase the impact of the accident.” Insurance companies have access to a shared database that contains information about your driving history, including any at-fault accidents. Switching insurance providers does not erase the impact of the accident but may provide an opportunity to find more competitive rates.

- “I can hide the accident from my insurance company to avoid rate increases.” Concealing an at-fault accident from your insurance company is not advisable. Insurance fraud is a serious offense and can lead to legal consequences. It is always best to be honest and transparent with your insurance provider to ensure that you are properly covered.

Seeking legal advice after an at-fault car accident

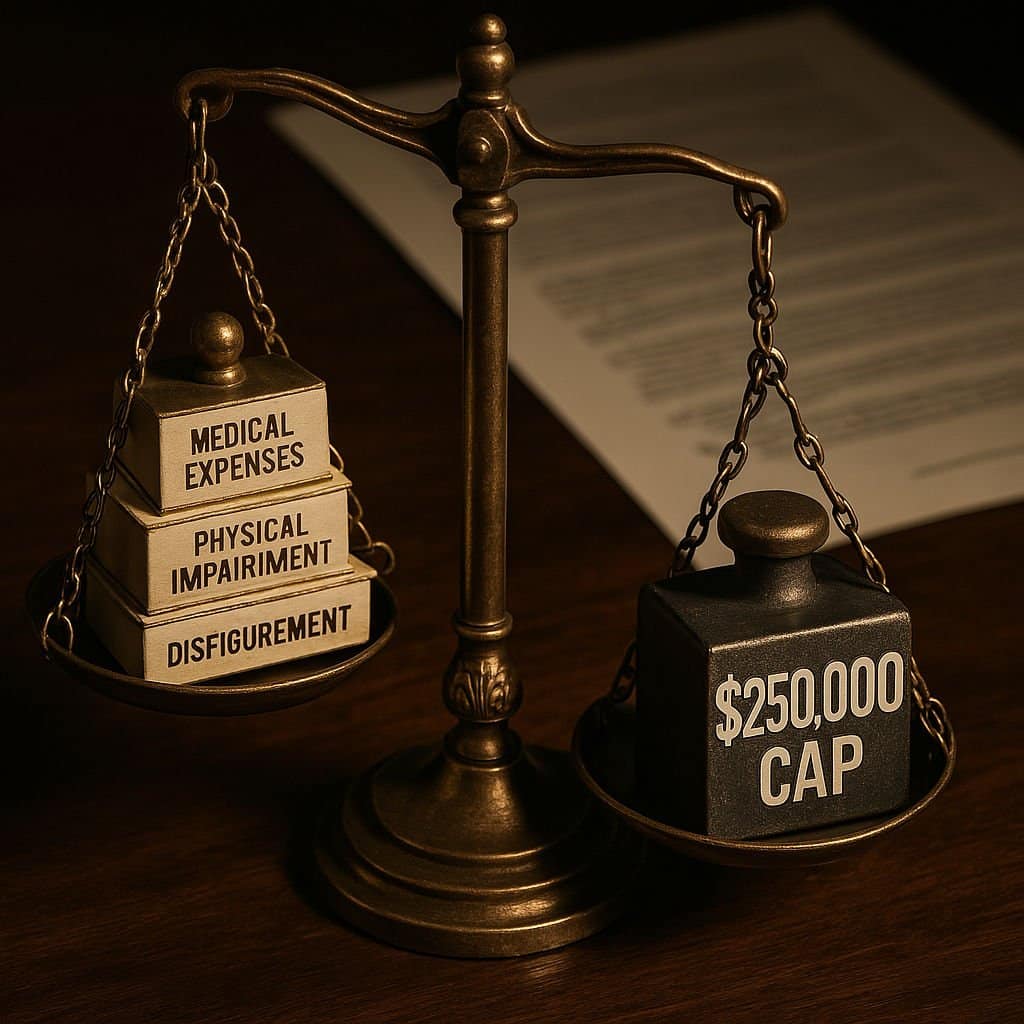

In some cases, seeking legal advice after an at-fault car accident may be necessary, especially if there are disputes about liability or significant damages. An experienced attorney can provide guidance on navigating the legal process, negotiating with insurance companies, and ensuring that your rights are protected.

When choosing a lawyer, look for someone with expertise in personal injury and car accident cases. They can help you understand your legal options, gather evidence, and advocate on your behalf to ensure that you receive fair compensation for your losses.

Texas insurance regulations for at-fault car accidents

In Texas, insurance regulations dictate how at-fault car accidents are handled. It is important to familiarize yourself with these regulations to understand your rights and responsibilities. Here are some key points to note:

- Minimum liability coverage: Texas law requires drivers to carry a minimum amount of liability coverage to protect themselves and others in the event of an accident. The minimum coverage includes $30,000 for each injured person, up to $60,000 per accident, and $25,000 for property damage.

- Comparative negligence: Texas follows a modified comparative negligence rule, which means that your compensation may be reduced if you are found partially at fault for the accident. If you are found to be more than 50% at fault, you may not be entitled to any compensation.

- Statute of limitations: In Texas, there is a statute of limitations for filing a personal injury lawsuit after a car accident. Generally, you have two years from the date of the accident to file a lawsuit. It is important to consult with an attorney to understand the specific deadlines that apply to your case.

Conclusion

Understanding the duration of an at-fault car accident’s impact on your Texas insurance record is crucial for making informed decisions about your coverage and understanding the financial implications. While an at-fault accident typically stays on your insurance record for three to five years, factors such as repeat offenses, severity of the accident, and traffic violations can prolong the impact. Taking steps to minimize the impact, such as completing defensive driving courses and practicing safe driving habits, can help improve your insurance record over time. Remember to report any at-fault accidents to your insurance company to ensure that you are properly protected and in compliance with your policy. And if you find yourself facing legal issues after an at-fault accident, seeking the advice of an experienced attorney can help protect your rights and ensure fair compensation. By understanding the regulations and taking proactive steps, you can navigate the impact of an at-fault car accident on your Texas insurance record with confidence.